Have you ever received an unexpected cashier's check, especially one seemingly from a reputable bank like Wells Fargo, and felt a flicker of excitement? While it might seem like a stroke of luck, it's crucial to approach such situations with caution. Counterfeit cashier's checks are a common tool used in various scams, and Wells Fargo, like other major banks, is often impersonated by fraudsters.

Falling victim to a fake Wells Fargo cashier's check scam can have devastating financial consequences. You might be asked to deposit the check and wire a portion of the funds back to the scammer. The check will eventually bounce, leaving you responsible for the wired amount and any overdraft fees.

This article aims to equip you with the knowledge to identify and avoid these scams. We'll delve into how these schemes work, common red flags, and practical steps to protect yourself. Understanding the mechanics of cashier's check fraud targeting Wells Fargo customers is essential for safeguarding your financial well-being.

Cashier's check fraud, in general, isn't new. Criminals have long exploited the perceived security of cashier's checks. However, with the rise of online marketplaces and digital communication, these scams have become more sophisticated and widespread. Scammers often target individuals selling goods online or those involved in online job opportunities. The allure of a seemingly guaranteed payment via a cashier's check can make victims less vigilant.

The key to avoiding Wells Fargo cashier's check fraud, or any cashier's check fraud, is skepticism. Never assume a cashier's check is legitimate, even if it appears to be from a well-known bank. Verify the check's authenticity directly with the issuing bank branch, not through any contact information provided by the person who sent you the check. Remember, if it sounds too good to be true, it probably is.

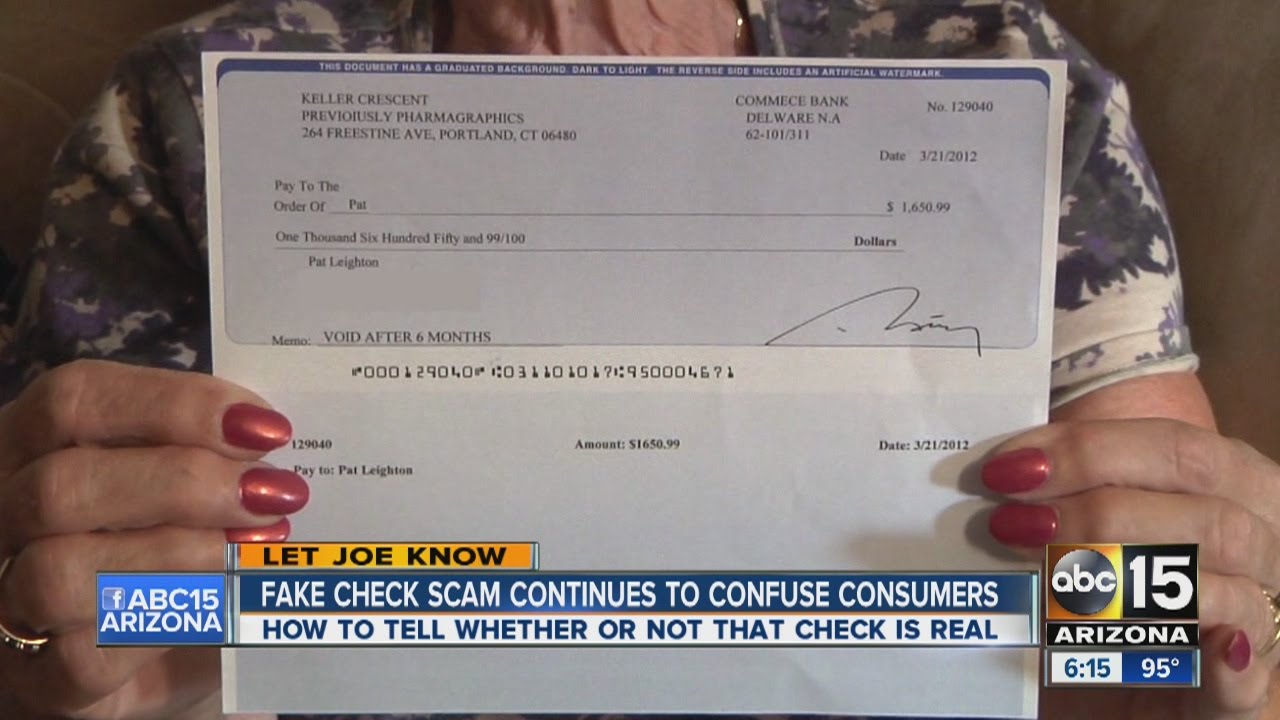

Fake cashier’s checks are often incredibly realistic, making them difficult to distinguish from genuine ones. Fraudsters may use sophisticated printing techniques to replicate bank logos and security features. They also leverage the reputation of established institutions like Wells Fargo to build trust and credibility with their victims.

One common scenario involves a scammer purchasing an item online and sending a cashier's check for an amount exceeding the agreed-upon price. They then ask the seller to deposit the check and return the difference. The check eventually bounces, and the seller loses the money they wired back.

There are no benefits to Wells Fargo cashier’s check fraud; it's a criminal activity with serious consequences for victims. Participating in such schemes, even unknowingly, can lead to financial losses, legal trouble, and damage to your credit score.

Advantages and Disadvantages of Being Aware of Wells Fargo Cashier's Check Fraud

| Advantages | Disadvantages |

|---|---|

| Protects you from financial loss. | Requires vigilance and skepticism. |

| Helps you avoid legal trouble. | Can make online transactions feel less straightforward. |

| Preserves your credit score. | Can lead to mistrust even in legitimate situations. |

Frequently Asked Questions:

1. How can I verify a Wells Fargo cashier’s check? Contact a Wells Fargo branch directly to verify the check's authenticity.

2. What should I do if I suspect a cashier’s check is fraudulent? Report it to Wells Fargo and your local law enforcement.

3. Can I be held liable for depositing a fake cashier’s check? Yes, you can be held responsible for the funds drawn against a counterfeit check.

4. Are there any online resources to help me identify fake checks? Yes, the FDIC and the Federal Reserve offer resources on identifying counterfeit checks.

5. How can I protect myself from cashier's check scams? Be wary of overpayments, unsolicited offers, and requests to wire money back.

6. What are some common red flags in cashier's check scams? Pressure to deposit the check quickly, requests for personal information, and deals that seem too good to be true.

7. Who should I contact if I'm a victim of a cashier's check scam? Contact Wells Fargo, your local police, and the Federal Trade Commission (FTC).

8. Is it safe to accept cashier's checks from strangers? It's generally risky to accept cashier's checks from individuals you don't know and trust.

Tips and tricks: Be wary of unsolicited offers, verify the check with the issuing bank directly, never wire money back to someone you don’t know, and trust your instincts.

Understanding the risks and intricacies of Wells Fargo cashier's check fraud, or any cashier's check fraud, is paramount in today's digital landscape. By staying informed and adopting a cautious approach, you can significantly reduce your vulnerability to these scams. Remember, verifying the authenticity of a cashier's check directly with the issuing bank is the most effective way to protect yourself. Don't let the allure of a quick profit cloud your judgment. Being proactive and informed is your best defense against falling victim to these fraudulent schemes. Taking the time to verify a check can save you from significant financial and emotional distress. Report any suspicious activity to the appropriate authorities, and help protect others from becoming victims. By understanding the methods employed by scammers, you empower yourself to make informed decisions and safeguard your financial well-being.

Benjamin moore blue black the moody hue transforming interiors

The ultimate guide to sherwin williams white exterior colors

Unlocking the power of gray paint transform your home with sophistication