Have you ever received a cashier's check that seemed too good to be true? It might be. Cashier's check fraud, including scams targeting Wells Fargo customers, is on the rise, and it's crucial to understand how these schemes work to protect your finances.

These scams often involve a seemingly legitimate reason for receiving a cashier's check, such as payment for goods sold online or an unexpected inheritance. The scammer might overpay and ask you to wire back the difference. The catch? The cashier's check is counterfeit, and you'll be responsible for the wired funds, leaving you out of pocket.

This article explores the intricacies of cashier's check fraud, focusing specifically on scams involving Wells Fargo accounts. We'll delve into how these scams operate, the devastating impact they can have on victims, and crucial steps you can take to protect yourself.

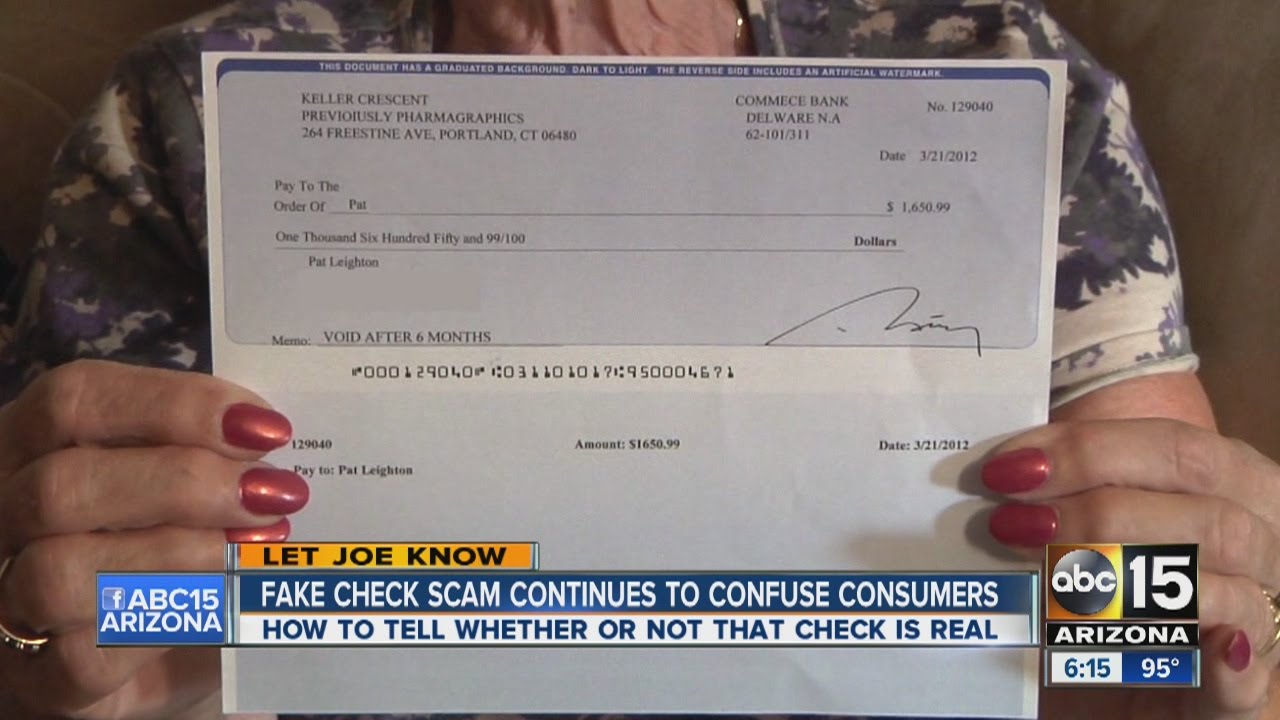

The rise of digital banking has unfortunately provided new avenues for scammers. While cashier's checks were once considered a secure form of payment, counterfeit checks have become increasingly sophisticated, making them difficult to distinguish from genuine ones. This has led to a surge in fraudulent activities, including those involving Wells Fargo, one of the largest banks in the United States.

Understanding how these scams work is the first step in protecting yourself. Typically, the scammer will initiate contact through email, text, or online marketplaces, offering a seemingly legitimate transaction. They will then send a cashier's check, often for an amount exceeding the agreed-upon price. The scammer will then provide a plausible reason for the overpayment and request that you wire back the difference. By the time the bank discovers the cashier's check is counterfeit, the scammer has disappeared with your money.

The history of cashier's check scams isn't new, but their evolution alongside technology has made them more prevalent and sophisticated. These scams exploit the trust people place in cashier's checks and the speed of electronic transactions. The main issues related to Wells Fargo cashier's check scams are similar to those impacting other banks, with scammers often impersonating legitimate businesses or individuals to gain victims' trust.

A cashier's check is a check guaranteed by a bank, drawn on the bank's own funds and signed by a cashier. While generally considered safe, counterfeit cashier's checks are a significant problem. For example, someone selling a car online might receive a counterfeit cashier's check for $20,000, even though the car is only worth $15,000. The scammer will ask for the $5,000 difference to be wired back, claiming a clerical error.

Advantages and Disadvantages of Cashier's Checks

| Advantages | Disadvantages |

|---|---|

| Generally considered a secure form of payment | Vulnerable to counterfeiting |

While there are no benefits to falling victim to a Wells Fargo cashier's check scam, understanding the scam can empower you to protect yourself.

Frequently Asked Questions

What should I do if I receive a suspicious cashier's check? Contact Wells Fargo immediately to verify its authenticity.

How can I tell if a cashier's check is fake? Look for inconsistencies in the check, such as blurry printing or mismatched fonts. Contact the issuing bank directly to verify the check's validity.

Can I recover my money if I've been scammed? It's difficult, but reporting the scam to the authorities and your bank is crucial.

Are online marketplaces safe for transactions? Exercise caution and be wary of deals that seem too good to be true.

How can I protect myself from cashier's check fraud? Never wire money back to someone who overpaid you with a cashier's check.

What information should I provide to Wells Fargo if I suspect a scam? Provide all details of the transaction, including the check number, sender's information, and any communication you've had with them.

Should I contact the police if I've been scammed? Yes, filing a police report is essential for documenting the fraud.

Are there resources available to help victims of cashier's check scams? Yes, organizations like the Federal Trade Commission (FTC) offer resources and support for scam victims.

Tips and Tricks to Avoid Cashier's Check Scams

Verify the legitimacy of the buyer or seller before engaging in any transaction. Be skeptical of overly enthusiastic buyers or sellers. If a deal sounds too good to be true, it probably is.

In conclusion, cashier's check scams, including those targeting Wells Fargo customers, are a serious threat. Understanding how these scams operate is the first line of defense. Be wary of unsolicited offers, verify the legitimacy of cashier's checks directly with the issuing bank, and never wire money back to someone who overpaid you with a cashier's check. While cashier's checks can be a useful payment method, it's crucial to remain vigilant and informed to avoid becoming a victim of these sophisticated scams. Protecting yourself starts with awareness and proactive steps. Report any suspicious activity to Wells Fargo and the appropriate authorities immediately. By working together, we can combat these fraudulent activities and ensure the safety of our financial transactions. Remember, your financial well-being is paramount, and taking these precautions can save you from significant financial loss and stress. Stay informed, stay safe, and protect your hard-earned money.

Unlocking serenity with behr dune grass paint

Navigating nevadas compensation landscape

The unsung hero your rav4s air filter and its vital part number