In today's fast-paced world, financial literacy is more critical than ever. Equipping the next generation with the tools to manage their finances responsibly is a crucial step toward their future success. A youth account, like those offered by Wells Fargo, can be a valuable tool in this endeavor, providing young people with hands-on experience in managing money.

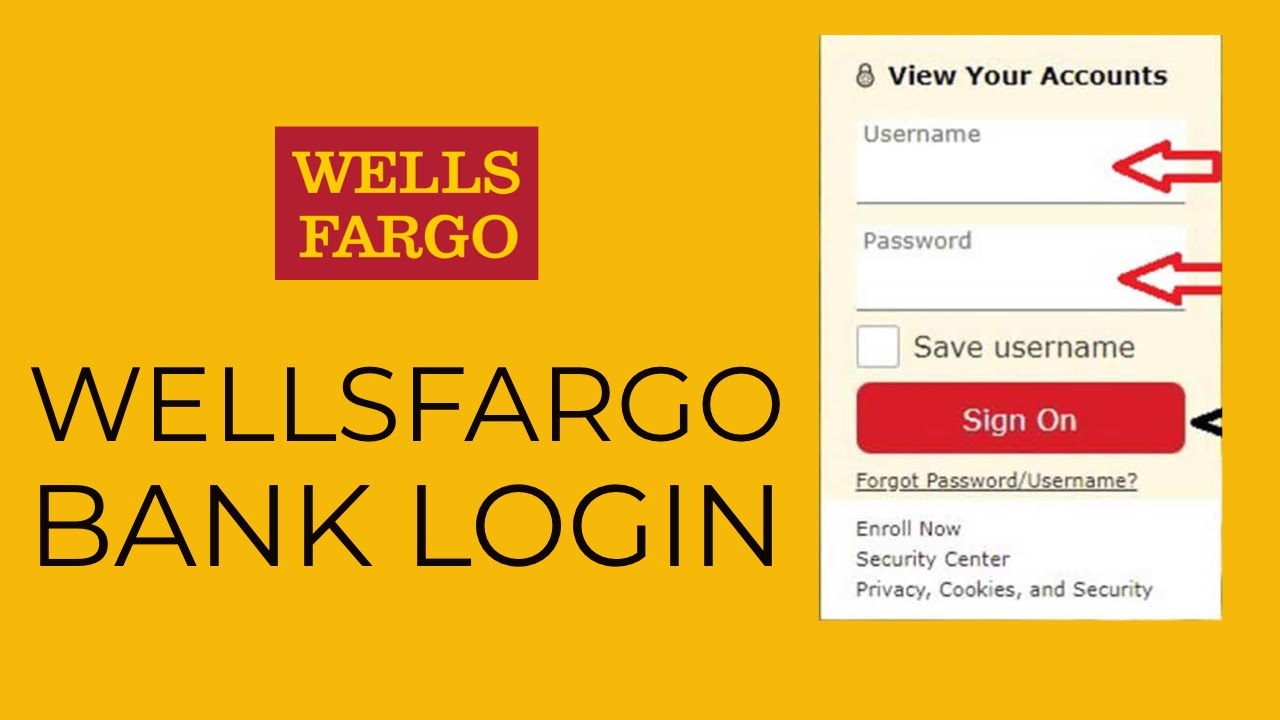

Navigating the world of youth banking can feel overwhelming, with various options and considerations. This comprehensive guide delves into the landscape of Wells Fargo accounts designed for younger individuals. We'll explore the ins and outs, addressing common questions and concerns to empower you to make informed decisions about your child's financial future.

A Wells Fargo account for kids provides a practical pathway for young people to learn about saving, spending, and the overall function of the banking system. It allows them to develop responsible financial habits early on, setting the stage for a secure financial future. This article aims to be your go-to resource for understanding Wells Fargo's offerings for younger clients.

While Wells Fargo doesn't specifically offer accounts labeled as "kid accounts," they do provide options suitable for young people, typically joint accounts with a parent or guardian. These accounts give minors access to banking services under adult supervision, fostering financial learning through real-world experience. This article clarifies the specifics of these accounts and their functionality.

Understanding the nuances of a joint account for a minor at Wells Fargo is crucial for maximizing its benefits. This includes understanding the responsibilities of the adult co-owner, the limitations placed on the minor's access, and the opportunities available for teaching financial literacy. We'll explore these aspects in detail, providing you with the knowledge you need to make the best choices for your family.

Wells Fargo, a prominent financial institution with a long history, has traditionally offered banking services for families. While specific product offerings evolve, the core principle of supporting families remains. Their current account options suitable for minors, like joint accounts, emphasize parental oversight and shared responsibility.

One of the key advantages of opening a Wells Fargo youth account (joint account) is the opportunity it presents for teaching financial responsibility. A practical, hands-on experience with banking can be more effective than abstract lessons. For instance, a child can learn the value of saving by depositing a portion of their allowance.

Another benefit is the convenience and security offered by a formal banking arrangement. Instead of holding physical cash, children can learn to manage funds electronically, understand the concept of interest, and learn how to track their spending. This can be particularly beneficial as online transactions become increasingly prevalent.

A joint account can also simplify allowance management. Parents can set up recurring transfers, automating the allowance process and reinforcing the concept of regular income. This removes the need for physical cash exchanges and provides a clear record of transactions.

Advantages and Disadvantages of Wells Fargo Youth Accounts (Joint Accounts)

| Advantages | Disadvantages |

|---|---|

| Teaches financial responsibility | Potential for disagreements between joint account holders |

| Convenient and secure money management | Limited control for the minor |

| Simplified allowance management | Requires parental involvement and oversight |

Best Practices:

1. Set clear expectations and guidelines with your child about account usage.

2. Regularly review account statements together and discuss spending habits.

3. Use the account as a teaching tool to explain concepts like budgeting and saving.

4. Encourage your child to set savings goals and track their progress.

5. Monitor account activity for any unauthorized transactions.

Frequently Asked Questions:

1. What type of account is best for a minor at Wells Fargo? - Typically, a joint account with a parent or guardian.

2. How do I open a joint account for a minor? - Visit a Wells Fargo branch with the required documentation.

3. What are the age restrictions for joint accounts? - This varies and can be confirmed with Wells Fargo directly.

4. Can a minor access online banking? - Generally, yes, with limitations determined by the adult co-owner.

5. Are there fees associated with youth accounts? - Fee structures can vary; consult Wells Fargo for details.

6. What happens to the account when the minor reaches adulthood? - Options include converting it to an individual account.

7. How can I teach my child about budgeting using the account? - Involve them in setting spending limits and tracking expenses.

8. What security measures are in place to protect the account? - Wells Fargo implements various security measures, including fraud monitoring and online security protocols.

Tips and Tricks:

Utilize online resources and educational materials provided by Wells Fargo to enhance your child's financial literacy.

In conclusion, a Wells Fargo youth account, structured as a joint account, can be a powerful tool for empowering the next generation financially. By providing practical experience with managing money, these accounts help instill responsible financial habits from a young age. While navigating the complexities of banking can seem daunting, open communication, clear guidelines, and active parental involvement are crucial for success. By embracing these principles, parents can equip their children with the skills and knowledge they need to navigate the financial landscape confidently. The benefits of early financial education extend far beyond managing a bank account. They contribute to a stronger sense of financial security, independence, and overall well-being, setting the stage for a brighter future. Take the first step today by exploring the options available and embarking on this journey towards financial empowerment with your child. Contact a Wells Fargo representative for the latest information on account options and features. Investing in your child's financial literacy is an investment in their future.

A royal union prince william and kates wedding date

Behr alpine frost paint your ultimate guide

Unlocking potential fc 24 live editor v24117