Are you intrigued by the dynamic world of online healthcare and its impact on the stock market? The rise of telehealth platforms has significantly changed the healthcare landscape, and Ping An Good Doctor stands as a prominent player in this transformative field. Understanding the factors that influence Ping An Good Doctor's stock valuation is crucial for both investors and those interested in the future of healthcare.

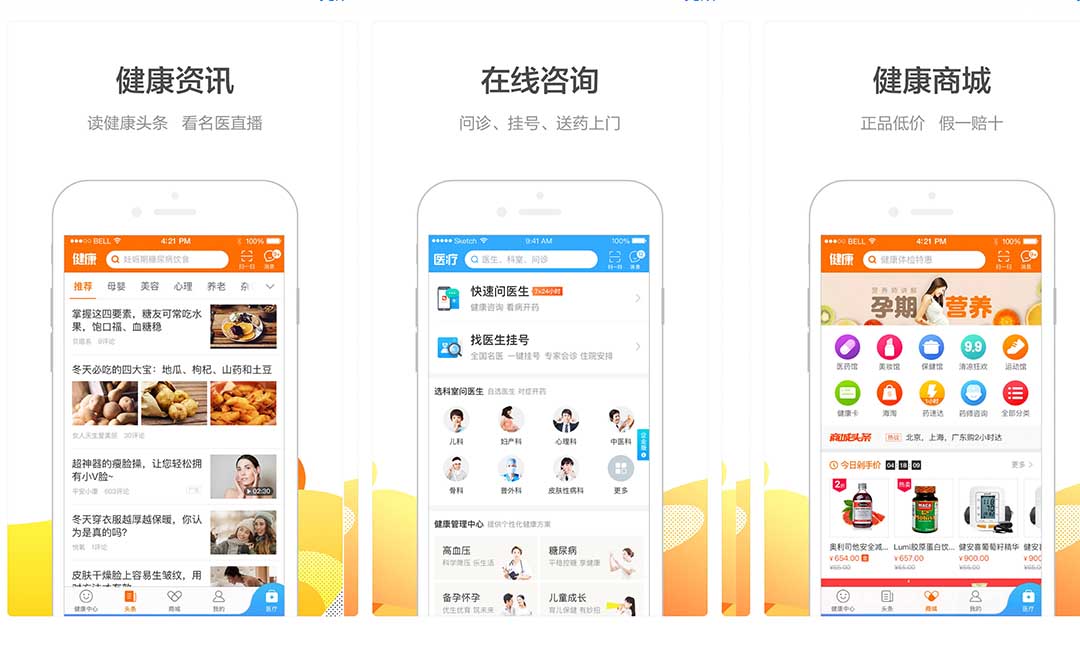

Ping An Good Doctor, a subsidiary of Ping An Insurance (Group) Company of China, is a leading online healthcare platform in China. Its services encompass online consultations, health mall, and health management. The company's stock, listed on the Hong Kong Stock Exchange, has experienced fluctuations, making its valuation a topic of considerable interest. Navigating this landscape requires a nuanced understanding of the forces at play.

The initial public offering (IPO) of Ping An Good Doctor generated significant buzz and investment. However, like many publicly traded companies, its stock price has encountered both periods of growth and decline. Analyzing these trends requires considering both the company's internal performance and broader market conditions. Factors such as regulatory changes, competitive pressures, and technological advancements all contribute to the complexity of evaluating Ping An Good Doctor's stock performance.

Examining the trajectory of Ping An Good Doctor stock price necessitates considering the company's financial performance, user growth, and strategic initiatives. Has the company successfully expanded its user base? How effectively has it monetized its services? These are critical questions to explore when assessing the underlying value of the company's stock. Understanding the market's perception of these factors is equally important in anticipating future price movements.

Evaluating Ping An Good Doctor stock involves considering a range of metrics. These might include revenue growth, profitability, market share, and the company's overall competitive position within the online healthcare sector. Beyond these fundamental indicators, market sentiment, investor confidence, and broader economic trends can also significantly impact the stock's value. A comprehensive approach to analysis requires examining both quantitative and qualitative factors.

Ping An Good Doctor emerged from Ping An Insurance's strategic vision to leverage technology in healthcare delivery. The company aimed to address challenges within China's healthcare system, such as access to quality care, particularly in underserved areas. Its importance lies in its potential to transform how healthcare services are accessed and delivered.

A common issue surrounding Ping An Good Doctor’s share price revolves around profitability and competition. Like many tech-driven healthcare companies, achieving sustainable profitability can be challenging, particularly in a rapidly evolving market with intense competition.

Investing in Ping An Good Doctor stock provides exposure to the burgeoning online healthcare market in China. This presents a significant growth opportunity, especially given the increasing adoption of digital health solutions.

One strategy for evaluating Ping An Good Doctor’s stock is to analyze its financial reports and compare its performance to industry benchmarks. This involves assessing metrics such as revenue growth, user acquisition costs, and operating margins.

Advantages and Disadvantages of Investing in Ping An Good Doctor Stock

| Advantages | Disadvantages |

|---|---|

| Exposure to the rapidly growing online healthcare market | Volatility of the stock price due to market fluctuations |

| Potential for high returns if the company achieves significant growth | Uncertainty about long-term profitability |

One real example is the stock price fluctuation after the company announced its quarterly earnings report. This highlights the sensitivity of the stock to market expectations and the company's financial performance.

FAQ:

1. What is Ping An Good Doctor? (A leading online healthcare platform in China)

2. Where is Ping An Good Doctor listed? (Hong Kong Stock Exchange)

3. Who is the parent company? (Ping An Insurance Group)

4. What services does it offer? (Online consultations, health mall, health management)

5. What factors affect its stock price? (Market trends, financial performance, regulatory changes)

6. Is it a profitable company? (Profitability remains a key challenge)

7. How can I invest in its stock? (Through a brokerage account with access to the Hong Kong Stock Exchange)

8. What are the risks involved? (Market volatility, competition, regulatory uncertainty)

A tip for understanding Ping An Good Doctor stock is to closely follow news and analysis related to the Chinese healthcare market and the company's competitive landscape.

In conclusion, understanding the dynamics influencing Ping An Good Doctor's stock price requires a multifaceted approach. By analyzing the company's performance, market trends, and the broader healthcare landscape, investors can gain valuable insights. The future of Ping An Good Doctor remains intertwined with the growth of online healthcare in China, presenting both opportunities and challenges. The company's ability to navigate this evolving landscape will ultimately determine its long-term success and the value it delivers to its shareholders. Staying informed, conducting thorough research, and considering both the potential benefits and risks are crucial for anyone interested in exploring investment in this dynamic sector. Carefully consider your own investment goals and risk tolerance before making any decisions related to Ping An Good Doctor's stock. The information presented here is for educational purposes and is not financial advice. Consult with a qualified financial advisor before making any investment decisions.

St cloud mn lodging your gateway to central minnesota

A timeless tale romeo and juliet book explored

Conquering the gaston your lake gaston dam crossing guide