In the labyrinthine corridors of modern finance, we often find ourselves grappling with the occasional errant transaction. A misplaced decimal, a hasty click, a mistaken recipient – these small slips can send ripples of anxiety through our carefully constructed financial landscapes. But what if there were a way to reclaim those funds, to undo the digital misstep and restore balance to our accounts? This exploration delves into the art of reversing bank transactions, offering a lifeline in the sometimes turbulent waters of personal finance.

Imagine a world without the safety net of transaction reversals. Businesses and individuals alike would be vulnerable to a cascade of errors, with little recourse for recovery. The very foundation of trust in our financial systems rests, in part, on the ability to rectify mistakes. Understanding the history and evolution of these reversal processes illuminates not only the mechanics of modern banking but also the intricate dance between technology, regulation, and human error.

From the early days of paper checks and in-person banking, the process of reversing a transaction was a laborious affair, often requiring multiple layers of authorization and physical paperwork. The rise of digital banking, while offering unprecedented convenience, also introduced new complexities to the reversal process. The speed and automation of electronic transfers necessitate equally rapid and efficient mechanisms for correction.

Stopping or reversing a bank transaction involves a delicate interplay of factors, including the type of transaction, the time elapsed since its initiation, and the policies of the financial institutions involved. A wire transfer, for instance, presents different challenges than a debit card purchase. The sooner one acts after realizing the error, the greater the likelihood of a successful reversal.

This guide aims to demystify the process of canceling, reversing, or recalling a bank transaction, providing practical insights and actionable steps to navigate the often-confusing terrain of financial recovery. Whether you're dealing with a fraudulent charge, a duplicate payment, or simply a change of heart, understanding the nuances of transaction reversals can empower you to take control of your finances.

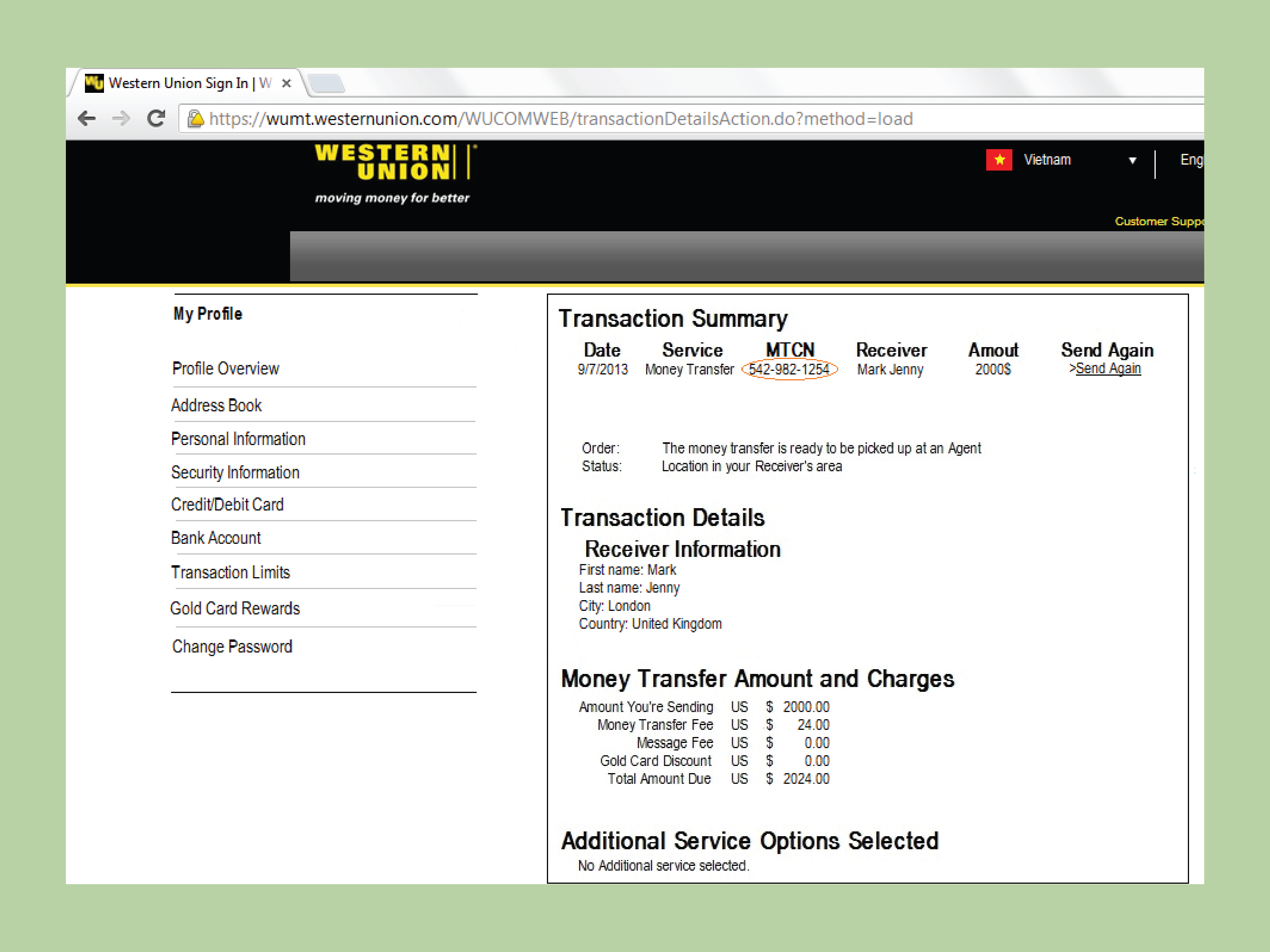

There are several ways to initiate a transaction reversal, from contacting your bank directly to utilizing online banking tools or disputing charges through your credit card company. Each method has its own set of procedures and timelines. For example, a stop payment order on a check might require specific information, such as the check number, date, and amount. Similarly, disputing a credit card charge often involves filling out a form and providing supporting documentation.

Benefits of successfully reversing a bank transaction include recovering lost funds, preventing financial losses due to fraud or errors, and maintaining accurate financial records. Imagine accidentally sending a large sum of money to the wrong recipient – the ability to reverse the transaction could prevent significant financial hardship. Similarly, catching a fraudulent charge early and reversing it can protect your credit score and prevent further unauthorized activity.

If you need to reverse a transaction, act swiftly. Contact your bank or financial institution immediately, providing them with all relevant details. Keep records of all communication and documentation related to the reversal request. Follow up regularly to ensure the process is progressing smoothly.

Advantages and Disadvantages of Reversing a Bank Transaction

| Advantages | Disadvantages |

|---|---|

| Recovery of lost funds | Potential fees or charges |

| Prevention of financial loss due to fraud or errors | Time-consuming process |

| Maintenance of accurate financial records | Not always guaranteed successful |

Best practices for reversing a bank transaction include regularly monitoring your account activity, acting quickly when you notice an error, keeping detailed records of all transactions, and familiarizing yourself with your bank's policies and procedures for reversals.

Frequently Asked Questions:

1. How long does it take to reverse a transaction? This depends on the type of transaction and the policies of the financial institution.

2. Are there fees associated with reversing a transaction? Some banks may charge fees for certain types of reversals.

3. What if my bank refuses to reverse a transaction? You may have other options, such as filing a dispute with your credit card company or contacting a consumer protection agency.

4. Can I reverse a transaction made with a debit card? Yes, but the process may differ from reversing a credit card transaction.

5. How can I prevent unauthorized transactions? Monitor your account activity regularly, use strong passwords, and be cautious about sharing your financial information.

6. What should I do if I suspect fraud? Contact your bank immediately and report the suspicious activity.

7. How can I track the status of my reversal request? Contact your bank and provide them with the reference number for your request.

8. What if I accidentally overpaid someone? Contact the recipient and request a refund. If they are unwilling to cooperate, you may need to explore other options, such as legal action.

In conclusion, the ability to reverse or cancel a bank transaction is a crucial aspect of modern financial management. Understanding the processes, timelines, and potential challenges associated with these reversals can empower individuals and businesses to navigate the complexities of the financial world with greater confidence and control. From preventing significant financial losses due to errors or fraud to simply rectifying a minor mishap, mastering the art of transaction reversals provides peace of mind and strengthens our relationship with the intricate systems that underpin our financial lives. Take proactive steps to familiarize yourself with your bank's policies, utilize available resources, and remain vigilant in monitoring your account activity. By doing so, you can ensure the security of your funds and navigate the financial landscape with confidence and control.

Sherwin williams stain guide

Towing a jeep grand cherokee the right way

Tri cities high school basketball in georgia a deep dive