Ever feel lost in a sea of numbers? Like you're navigating the financial world without a map? In accounting, there's a powerful tool that can bring clarity and order to the chaos: the worksheet (or, as it's known in Spanish, "hoja de trabajo en contabilidad"). It's the unsung hero of financial organization, and understanding its purpose can transform how you approach your accounting tasks.

Think of an accounting worksheet as a bridge. It connects the raw data of your transactions to the polished, finalized financial statements. It's a behind-the-scenes workspace where you can analyze, adjust, and refine your figures before presenting them to the world. This intermediate step, while often overlooked, is crucial for accuracy and ensuring your financial reporting is rock solid.

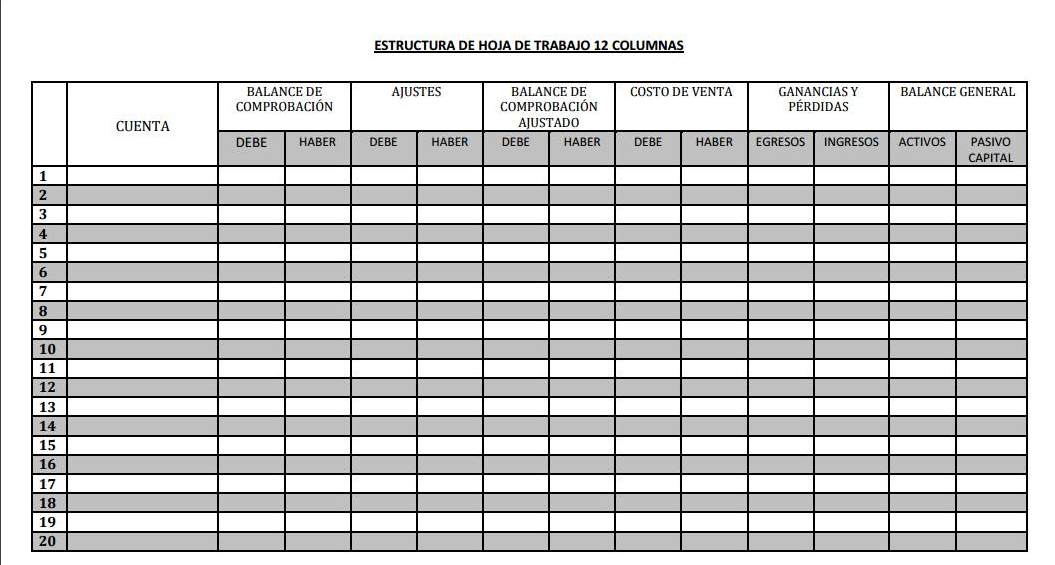

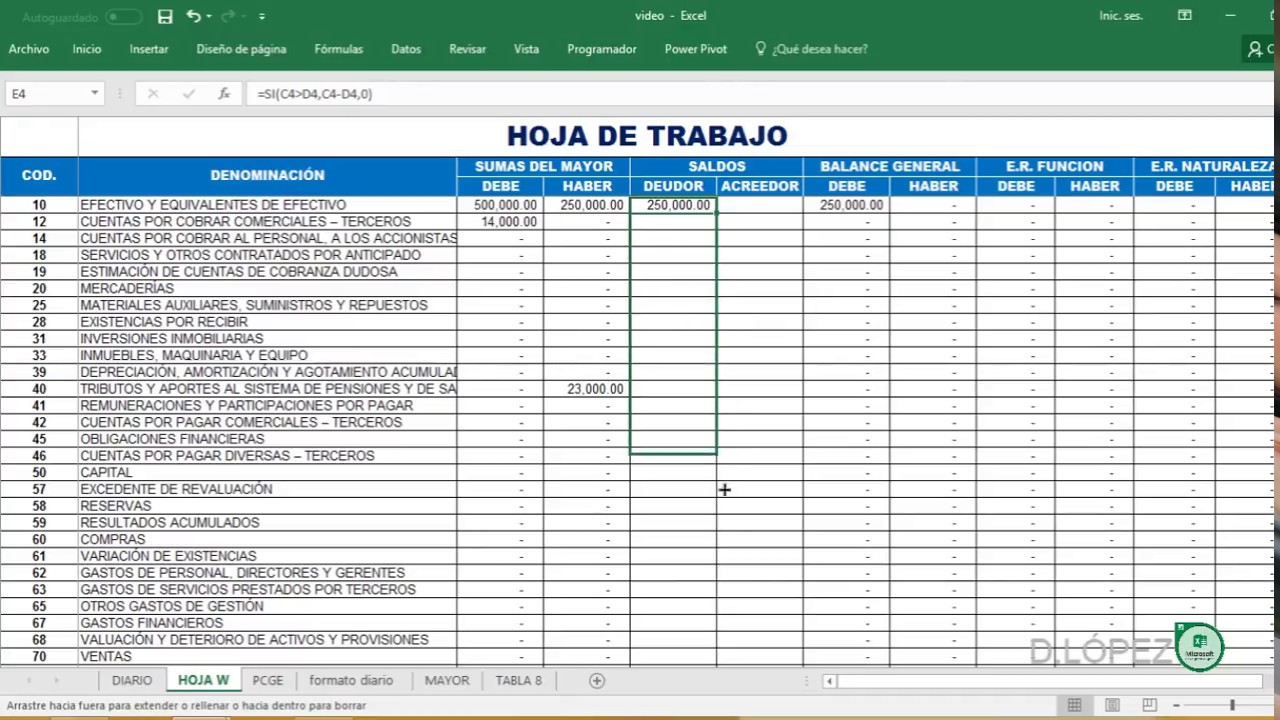

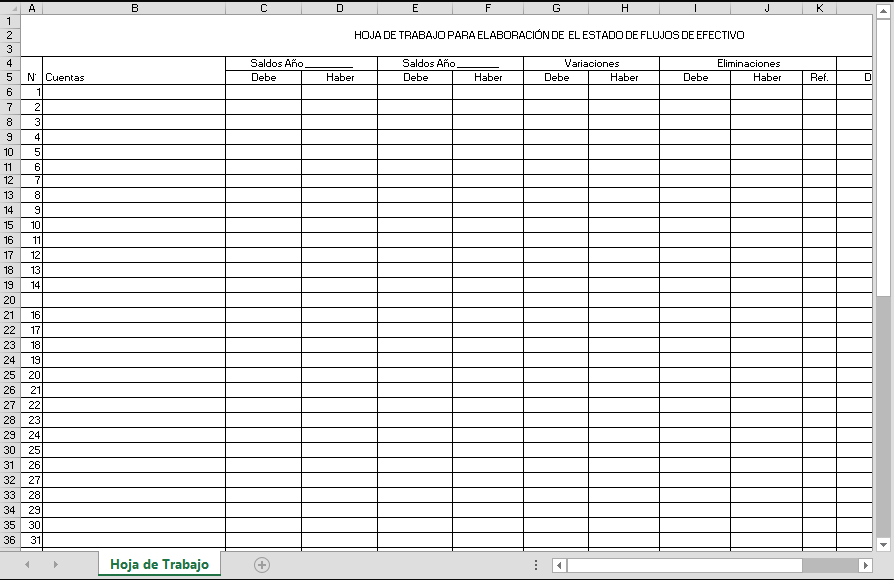

So, que es hoja de trabajo en contabilidad? Simply put, it's a structured document, often in spreadsheet format, used to organize and summarize accounting data. It allows you to gather all your trial balance information, make adjusting entries, and prepare your financial statements in a systematic way. Whether you're a seasoned accountant or just starting out, understanding this tool is essential for effective financial management.

The historical roots of accounting worksheets are intertwined with the development of double-entry bookkeeping. As businesses became more complex, the need for a systematic way to organize transactions and prepare financial statements became apparent. Worksheets emerged as a tool to facilitate this process, allowing accountants to perform calculations and adjustments before finalizing the books. Their importance has only grown with time, particularly with the rise of digital spreadsheets.

One of the primary advantages of using a worksheet is improved accuracy. By providing a structured format for recording and adjusting entries, it minimizes the risk of errors. This is particularly beneficial in complex accounting scenarios where multiple adjustments are required. The organized layout of a worksheet allows you to clearly see the impact of each adjustment on the financial statements, ensuring a more accurate and reliable final product.

A simple example: imagine a small business needs to record depreciation expense at the end of the year. The worksheet allows them to input the adjusting entry for depreciation, see its impact on both the income statement and balance sheet, and ensure the accounting equation remains balanced. This streamlined process reduces the chance of errors that might occur if adjustments were made directly in the general ledger.

Three key benefits of using worksheets are: improved accuracy (as mentioned above), enhanced efficiency by streamlining the financial statement preparation process, and better understanding of the relationships between different financial statement elements. By seeing how adjustments impact various accounts, you gain a deeper insight into the interconnectedness of your financial data.

A simple action plan for implementing worksheets involves: 1) Gathering your trial balance data; 2) Inputting the data into the worksheet; 3) Making necessary adjusting entries; 4) Extending the adjusted balances to the income statement and balance sheet columns; and 5) Preparing your financial statements based on the worksheet data.

Advantages and Disadvantages of Using Worksheets

| Advantages | Disadvantages |

|---|---|

| Improved Accuracy | Can be time-consuming for simple adjustments |

| Enhanced Efficiency | Not a formal financial statement |

| Better Understanding of Financial Relationships | May require specialized software |

Best Practices: 1) Use a consistent format; 2) Clearly label all accounts; 3) Double-check your calculations; 4) Review the worksheet for errors; 5) Keep a backup copy.

FAQ: 1) What is an accounting worksheet? (A tool to prepare financial statements.) 2) Why are they important? (For accuracy and organization.) 3) What are the key components? (Trial balance, adjustments, financial statement columns.)

In conclusion, the accounting worksheet, or "hoja de trabajo en contabilidad," is a powerful tool for achieving clarity and accuracy in your financial reporting. It's a bridge between raw data and polished statements, offering a workspace for analysis and adjustments. By understanding its purpose, benefits, and best practices, you can unlock a deeper understanding of your financial health and make more informed decisions. Embracing the worksheet is an investment in your financial success. Whether you're a small business owner, a student, or a seasoned professional, the worksheet is a valuable asset in navigating the complex world of accounting.

Mastering the light cahill nymph a fly tying guide

Discover the magic of big island taro farm tours

Unlocking the secrets of great lakes skipper boat parts